AMC Networks (NASDAQ:AMCX – Get Free Report) is anticipated to announce its Q4 2025 results after the market closes on Wednesday, February 11th. Analysts expect the company to announce earnings of $0.50 per share and revenue of $581.8250 million for the quarter. Investors are encouraged to explore the company’s upcoming Q4 2025 earning overview page for the latest details on the call scheduled for Wednesday, February 11, 2026 at 4:30 PM ET.

AMC Networks (NASDAQ:AMCX – Get Free Report) is anticipated to announce its Q4 2025 results after the market closes on Wednesday, February 11th. Analysts expect the company to announce earnings of $0.50 per share and revenue of $581.8250 million for the quarter. Investors are encouraged to explore the company’s upcoming Q4 2025 earning overview page for the latest details on the call scheduled for Wednesday, February 11, 2026 at 4:30 PM ET.

AMC Networks (NASDAQ:AMCX – Get Free Report) last announced its earnings results on Friday, November 7th. The company reported $0.18 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.31 by ($0.13). The business had revenue of $561.74 million for the quarter, compared to analyst estimates of $549.27 million. AMC Networks had a positive return on equity of 11.67% and a negative net margin of 6.03%.The company’s revenue for the quarter was down 6.3% compared to the same quarter last year. During the same period last year, the firm earned $0.91 EPS. On average, analysts expect AMC Networks to post $3 EPS for the current fiscal year and $2 EPS for the next fiscal year.

AMC Networks Price Performance

Shares of NASDAQ AMCX opened at $7.63 on Monday. The firm has a 50-day simple moving average of $8.86 and a 200-day simple moving average of $7.98. The company has a quick ratio of 2.12, a current ratio of 2.12 and a debt-to-equity ratio of 1.76. The stock has a market capitalization of $332.13 million, a price-to-earnings ratio of -2.03 and a beta of 1.12. AMC Networks has a 52 week low of $5.41 and a 52 week high of $10.27.

Analysts Set New Price Targets

Read Our Latest Report on AMC Networks

Institutional Investors Weigh In On AMC Networks

A number of institutional investors have recently made changes to their positions in the stock. Marshall Wace LLP raised its stake in shares of AMC Networks by 39.2% in the 2nd quarter. Marshall Wace LLP now owns 1,419,545 shares of the company’s stock valued at $8,901,000 after acquiring an additional 399,478 shares during the period. Russell Investments Group Ltd. increased its holdings in AMC Networks by 902.2% in the 3rd quarter. Russell Investments Group Ltd. now owns 286,603 shares of the company’s stock valued at $2,362,000 after purchasing an additional 258,005 shares during the last quarter. Squarepoint Ops LLC purchased a new stake in AMC Networks in the third quarter valued at approximately $1,328,000. Bridgeway Capital Management LLC lifted its stake in AMC Networks by 26.9% during the third quarter. Bridgeway Capital Management LLC now owns 651,051 shares of the company’s stock worth $5,365,000 after purchasing an additional 137,885 shares in the last quarter. Finally, UBS Group AG boosted its position in shares of AMC Networks by 13.2% during the third quarter. UBS Group AG now owns 1,170,464 shares of the company’s stock worth $9,645,000 after buying an additional 136,771 shares during the period. 78.51% of the stock is currently owned by institutional investors and hedge funds.

About AMC Networks

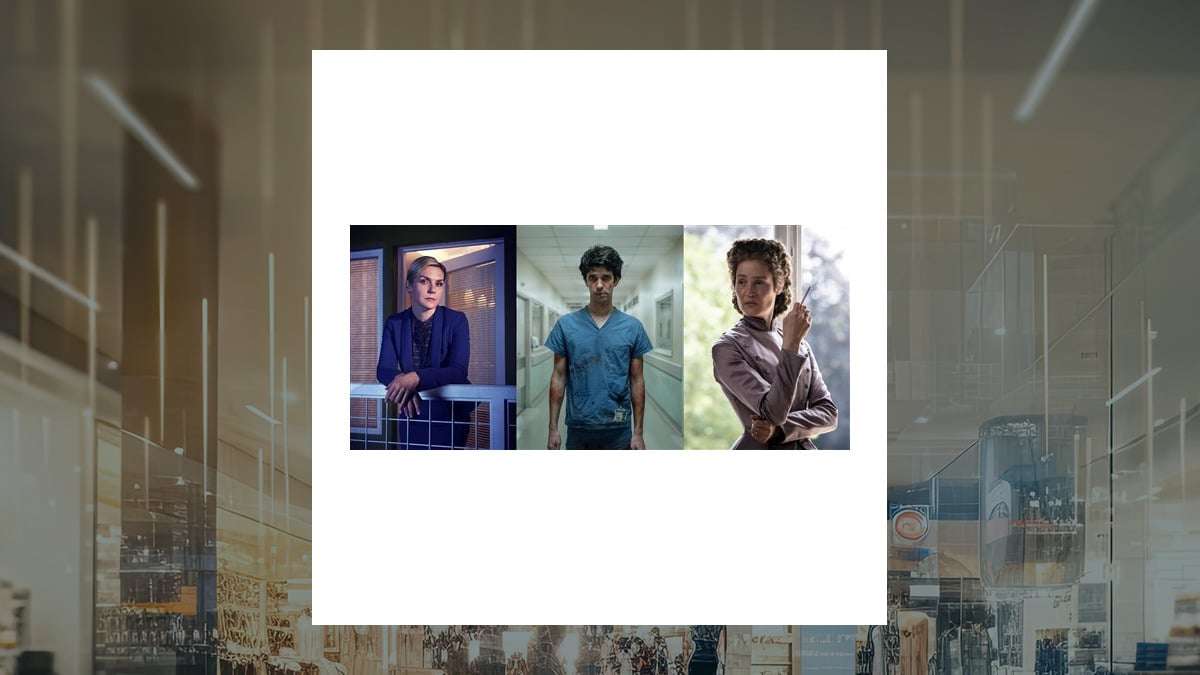

AMC Networks Inc (NASDAQ: AMCX) is a global entertainment company that specializes in the development, production and distribution of premium content for television and streaming platforms. Headquartered in New York City, the company operates a portfolio of pay television channels in the U.S. and abroad, and offers direct-to-consumer streaming services that feature both original programming and licensed fare. AMC Networks is best known for critically acclaimed series such as “Breaking Bad,” “Mad Men” and “The Walking Dead,” and it continues to invest in new scripted and unscripted content across a range of genres.

The company’s core television networks in the United States include AMC, IFC, Sundance TV and WE tv, while its joint venture with BBC Studios supports BBC America.

Featured Articles

- Five stocks we like better than AMC Networks

- The day the gold market broke

- Your Bank Account Is No Longer Safe

- What a Former CIA Agent Knows About the Coming Collapse

- He just nailed another gold prediction?…

- ~$1.5T SpaceX IPO: Pre-IPO Opportunity

Receive News & Ratings for AMC Networks Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings for AMC Networks and related companies with MarketBeat.com's FREE daily email newsletter.