Home » Energy & Mining

Oil Prices Drop to Low of Three Months on Rig Count

Oil prices fell to a low of three months Monday despite efforts by OPEC to curb output of crude. The prices were pulled down in part due to U.S. drillers adding more rigs. Brent crude was off 11 cents equal to 0.21% to $51.26 a barrel... More of this article »

The 2016 oil market: a year in review

For many energy traders, 2016 has been as brutal for them as it has been for celebrities. With prices sinking to lows that have not been seen in decades, small businesses and investors have felt the pain of plunging and unpredictable... More of this article »

What’s next for the oil market as it reaches a critical point?

2016 has proven to be a stressful time for oil traders and producers alike. With prices hitting a 13-year low in February, this year proved to be the breaking point for many businesses in the industry. As the months wore on, however,... More of this article »

Exxon Issues Warning on Reserves After Posting Drop in Profit

On Friday, Exxon Mobil Corp issued a warning that it could be forced to end close to 20% of its future gas and oil prospects as it yields to the steep decline in energy prices around the world. Under an investigation by New York state... More of this article »

Shell Posts Disappointing Results As Profit Hit by BG Deal and Oil

Royal Dutch Shell has posted a disappointing quarterly drop in profit of more than 72%, which it blamed on costs that were related to its BG Group takeover for $54 billion and weak prices of oil. Shell missed estimates of analysts... More of this article »

DONG Energy Stock Surges After Largest European IPO in 2016

DONG Energy shares jumped by up to 10% Thursday after the utility and wind farm developer based in Denmark scored the largest initial public offering thus far in 2016. The company has built over 25% of the offshore wind farms in the... More of this article »

SunEdison Said to be Preparing to File Bankruptcy

Struggling SunEdison, a solar developer, is preparing to file bankruptcy in the next few weeks, reported the Wall Street Journal on Friday. The paper cited people who had been familiar with the situation. The shares of the company... More of this article »

West Virginia Gives Tax Break to Natural Gas and Coal

Photo Credit: fungann via Compfight cc West Virginia Governor Earl Ray Tomblin recently approved a tax break bill on February 29. On Monday, the Democratic governor signed the bill that drops 56 cents/ton of severance surtaxes for... More of this article »

Gas Prices Might Reach $1 Per Gallon

In some gasoline stations across the country, the per gallon price of regular has fallen to less than $1.42. Two organizations that track the prices of gasoline say that prices of below $2 across the U.S. will be a common occurrence. As... More of this article »

BP Shuts Down Production In North Sea As Precaution (NYSE:BP)

BP has ordered more than 230 staff to leave the Valhall field in Norwegian waters and has shut down production in the area as a precaution. At the nearby Ekofisk field, ConocoPhillips halted output and evacuated workers by helicopter.... More of this article »

Duke Energy Renewables Business Taking Off (NYSE: DUK)

Duke Energy’s Renewables business produces renewable energy for sale primarily to other utilities and commercial customers. The business began as a start-up in 2009 and has grown into one of the country’s biggest players... More of this article »

Maersk Cutting 12% of Jobs Related to Oil

A.P. Moeller-Maersk is planning to cut up to 12% of its global workforce in its oil unit amidst the lower prices of crude that have remained at lows for the past year. The job cutting move is an attempt to help Maersk Oil fulfill its... More of this article »

Alcoa Splitting Company into Two

On Monday, Alcoa Inc announced that it would split the company into two separate entities – its aluminum smelting operations that are struggling from its lightweight metals production from its faster growing automotive and aerospace... More of this article »

Total Slashing Spending as Price of Oil Hits Hard

Total, the energy group based in France announced on Wednesday that it was slashing its capital spending, while delaying the start of several projects and upping its targets for cost cutting in a response to the dramatically lower... More of this article »

Ford and Alcoa Expand Deal for Aluminum

Ford Motor Company has reached a new deal with Alcoa that will expand its aluminum use in the F-150 pickup as well as in other vehicles. A big change for the lightweight metal as the car industry has long favored the use of steel. The... More of this article »

Alcoa Starts First Quarter Earnings Season

Alcoa as usual has unofficially started the earnings season for the 2015 first quarter on Wednesday with results where profit beat expectations but revenue did not, hinting that the upcoming earnings reports deluge might be a rough... More of this article »

General Electric Profit Beats Estimates

General Electric Co surpassed earnings estimates by analysts for the fourth quarter with increased sales in its power and water segment, offsetting the impact of a drop in oil prices. The largest supplier in the world of heavy-duty... More of this article »

Alcoa Ends Best Year in Past Six Years

Alcoa posted its earnings report for the fourth quarter following the closing bell on Monday, which marked the traditional start of the yearend reporting season. It was a good start as well. The largest aluminum producer in the country... More of this article »

Saudis See Recovery in Oil While UAE Urges Cuts by Non-OPEC

The United Arab Emirates and Saudi Arabia reiterated their pledges to maintain the same production of crude, blaming the producers who are non-OPEC for the oil glut that has driven the price down to its lowest of nearly 5 years. Suppliers... More of this article »

German Gas Deal Killed by Russian Crisis

Fallout continues to spread from the crisis in Russia with a big gas deal involving Germany being cancelled. BASF said it dropped its plans to hand complete control of its gas trading and storage business to Gazprom from Russia in... More of this article »

Alcoa Beats Forecasts on Higher Prices for Aluminum

Alcoa Inc reported an increase in profit for the third quarter that was strong than had been expected on Wednesday as higher prices for aluminum and a reduction in costs helped drive a recovery in its unit that produces its aluminum. Klaus... More of this article »

Exxon Mobil Wants Ban on Exports of U.S. Crude Lifted

During a business conference last week in Houston, Rex Tillerson the CEO at ExxonMobil said that if the government of the U.S. would end the ban on export of crude oil from the U.S. that is decades old, there would be a spike in job... More of this article »

Futures in Crude Bounce on Stockpile Use in U.S.

On Thursday, futures in crude oil were recovering some of ground that had been lost the past week on recent news that more of the U.S. stockpile is being uses than over the last few months. September delivery Brent crude was up by... More of this article »

Alcoa to Start Earnings Season Late Tuesday

There is an expectation that the aluminum giant will beat forecasts from analysts when it reports its revenue and earnings on Tuesday after the closing bell on Wall Street. Alcoa, Inc the world’s third largest producer of aluminum... More of this article »

Close to Half of Oil and Gas Wells in Wyoming Not Inspected

Nearly half of the newly drilled gas and oil well that are considered a high risk for pollution in Wyoming were not inspected during a period of three years, according to a news agency’s review of data from the federal government. Officials... More of this article »

Ikea Investing in Illinois Wind Farm

Home goods behemoth Ikea is doing more than designing and building furniture. The company has invested in a wind farm in Vermilion County Illinois about 150 miles to the south of Chicago. The farm will be big enough to ensure that... More of this article »

Alcoa Shares Increase After Earnings Beat Estimates

Alcoa Inc opened the first quarter earnings season reporting a drop in adjusted profit for the first quarter, as prices on aluminum fell. However, earnings were ahead of expectations by analysts and shares of the aluminum producer... More of this article »

How Natural Disasters Effect Economics

Lightning can strike even in the safest place. Whether you live near a volcano, along a river that floods or in a tornado alley, there’s always a possibility of natural disaster. Once it happened, economy suffers. It might take few... More of this article »

White House Revise Exports Limits on Crude Oil

On Saturday, the Obama administration left open the door to revisiting the crude exports limits that have been in place for close to four decades. The administration said following a Senate Energy Committee hearing on the current ban... More of this article »

Alcoa Posts Loss in Fourth Quarter of $2.3 Billion

Alcoa, Inc. reported a loss in the fourth quarter of $2.3 billion Thursday as lower prices of aluminum caused the company to make a write down in the value of its acquisitions that were made more than 10 years ago. Without those huge... More of this article »

Exxon Mobil Stake of $3.7 Billion Purchased by Berkshire

Berkshire Hathaway has reported the purchase of a stake valued at $3.7 in Exxon Mobil Corp. The company, owned by Warren Buffett, disclosed its largest holding since 2011. The company owned as of September 30, 40.1 million Exxon shares... More of this article »

Alcoa Exceeds Earnings Estimates

Alcoa, Inc the largest producer in the U.S. of aluminum reported quarterly earnings that beat forecasts after its smelting sector returned to be profitable and results were better at one of its units that makes aerospace and auto parts. Net... More of this article »

Exxon Offering Health Care to Same-Sex Married Couples

After drawing a great deal of criticism for its policies in relation to its lesbian and gay workers, Exxon Mobil Corporation, announced on Friday that it is extending its health insurance along with other benefits for employees to... More of this article »

Crisis in Syria Causing Oil and Gas to Increase

The usual drop in September that is expected for gas prices, might not take place this year. In the U.S. the national average for a gallon of gasoline is $3.55, which is down from last month’s average of $3.63. By the early part... More of this article »

Chevron Agrees to Pay Fine, Give Natural Gas Buses and Clean Up Emissions

Chevron agreed to settle with the US Environmental Protection Agency for pollution violation at its Salt Lake City refinery. Under the deal, the company will pay $284,000 in fines and purchase four new compressed natural gas school... More of this article »

Halliburton says it Destroyed Evidence in Gulf Spill

Halliburton officials admitted that evidence was destroyed in the oil spill disaster at Deepwater Horizon in the Gulf of Mexico. The company will enter a guilty plea to criminal charges, said the Department of Justice on Thursday. In... More of this article »

GE Earnings Up, Stock Rises

General Electric Co. announced that its earnings for the second quarter has increased by 0.9%, as the huge conglomerate reported it had lower costs, but its adjusted earnings dropped as revenue fell below Wall Street estimates. Nevertheless,... More of this article »

Export Permit Delays, Cost Gas Companies Millions

Rex Tillerson, the chief at Exxon Mobil said that delays in getting permits for natural gas exports approved has cost and is costing companies in the U.S. millions of dollars each day. He also said that rival foreign companies are... More of this article »

Chile Fines Barrick Gold Corp Millions

The Chilean government created the Environmental Superintendency recently to make certain that its environmental laws were adhered to. At the end of 2012, the governmental entity began its operations because of the growing concern... More of this article »

White House Considering Expanding Nature Gas Exports

Natural gas production in the U.S is setting new records annually. Times of surging prices because of shortages are a thing of the past and talk now is about how much of the natural resource should be exported. Just a couple of years... More of this article »

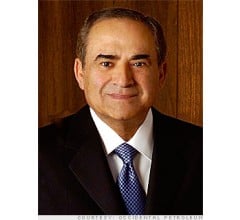

Oil Executive Vote Out by Shareholders

One of the Oil Industry’s highest paid executives in the U.S. was pushed out of his job this week. Occidental Petroleum Corp investors forced Ray Irani the Executive Chairman out. Company investors voted overwhelmingly to have Irani... More of this article »

Earnings for Caterpillar Drop as Mining Orders Shrink

Caterpillar, Inc. the largest maker of construction and mining equipment in the world reported its sales and earnings for the first quarter on Monday. The company’s results fell short of estimates by Wall Street, as orders slowed... More of this article »

GE Stocks Fall after CEO Cites Weakness in Europe

General Electric fell Friday morning even if its earnings and revenue were equal to Wall Street’s expectations. The drop was attributed to the concerns about Europe. Chairman and CEO Jeff Immelt said that GE planned for a challenging... More of this article »

Profits increase at GE for 2013 First Quarter

General Electric, the largest industrial conglomerate by market capitalization in the U.S. announced its profits had increased by 14% during the first quarter of 2013. That increase was obtained even though the company’s results... More of this article »

Nevada Wind Farm Under Investigation for Death of Eagle

The US Fish and Wildlife Service is conducting a probe on the death of a golden eagle at the Spring Valley Wind Farm, which is near the Utah border. Pattern Energy owns the 152 megawatt wind energy facility that sells power to Las... More of this article »

Natural Gas Deposits to start Flowing in Israel

Israel has realized that its recent discovery of large natural gas reserves offshore is a mixed blessing. The flow of natural gas from one of the two fields is expected within days. Expects in natural gas believe the new discovery... More of this article »

Weekly Price of Crude dropping for first time since October

Oil is on track to fall this week for the first weekly drop since mid October, as a forecast for economic growth in Germany was lowered and an earthquake in Japan created worry that consumption of crude might be lowered. Bundesbank,... More of this article »

EPA Adopts New Water Pollution Rules for Florida

The US Environmental Protection Agency is set to adopt new set of state and federal water pollution rules for the state of Florida. This resulted from the long court battle with environmental groups that wanted the federal version... More of this article »